Success and challenges of Georgian tobacco taxation policy

Vano Tsertsvadze

Doctor of social sciences

Professor

Georgian Institute of Public Affairs

National Center for Disease Control of Georgia

Lali Khurtsia

Doctor of economics

Assistant professor

Tbilisi State University

Abstract. Georgia has recently taken a major step toward compliance with the WHO FCTC, Georgia also ratified the association agreement with the European Union. According to these Agreements Georgia is obliged to harmonize its tobacco tax policy and substantially expand smoke-free places. The article overviews achieved goals toward smoke reduction and budget revenues using secondary data and reveals the reasons why tobacco policy was not successful in recent years.

Key words. Tobacco policy, taxation, tax, excise, ad valorem, budget, revenues, prevalence, harm reduction, smoking.

Introduction

The goal of tobacco policy in Georgia, as in the world, is to reduce the number of tobacco users and related diseases caused by tobacco consumption and to ensure budget revenues at an appropriate level. Legal restrictions and tax rates are actively used to achieve these goals.

Since 2017, in order to reduce the harm to health and economic costs caused by tobacco consumption, Georgia adopted impressive amendments to the “law on tobacco control”, “law on advertising”, “law on broadcasting” and the Code of Administrative Offenses. These changes banned smoking in public places; All types of advertising of tobacco products, tobacco accessories and/or devices for tobacco consumption were prohibited; Tobacco manufacturers became limited in providing sponsorship to any activities; The area of warnings on the dangers of smoking was Increased from 30 to 65 percent on cigarette boxes, and graphical images on health risk warnings have become mandatory. From January 2023, a new law – “the technical regulation on the standardization of tobacco products and their packaging” comes into force, and all tobacco products intended for sale in Georgia will be sold in accordance with standardized technical specifications (packaging color, box size, weight, inscription).

Tax Structure of Tobacco Taxation in Georgia

Along with legislative restrictions, important steps were taken in the field of taxation. The legislation of Georgia defines the following types of tobacco products, which, like other countries, are combined into codes of the national commodity nomenclature of foreign economic activity. the Tax Code of Georgia (Article 188) and the National Commodity Nomenclature of Foreign Economic Activity give the definition of the following tobacco products:

2401* – raw tobacco; Tobacco waste:

2402 10* – Cigars, cigars with the cut ends, and cigarillos (thin cigars), containing tobacco:

2402 20* – Cigarettes, containing tobacco:

2403 11 000 00 – “Hook” tobacco, according to Note 1 to the subheading of this group

2403 91 000 00 – “Homogenized” or “reconstituted” tobacco

2403 99 100 00 – Chewing or snuffing tobacco

2403 99 900* – Tobacco products consumed by means of electrical equipment:

3824 90 980 01 – Liquids, with or without nicotine, for use with electronic cigarettes

The structure of taxation of tobacco products in Georgia is simple. The following four types of taxes apply: VAT, fixed excise duty, ad valorem excise duty, and customs duty. All taxes and their rates are defined in the Tax Code of Georgia.

VAT – Value Added Tax, which applies to all goods that are sold to end users. The base for calculating VAT is retail price exclusive of tobacco products and equals 18%.

Import tax – The base for calculating is the CIF value which equals 12%.

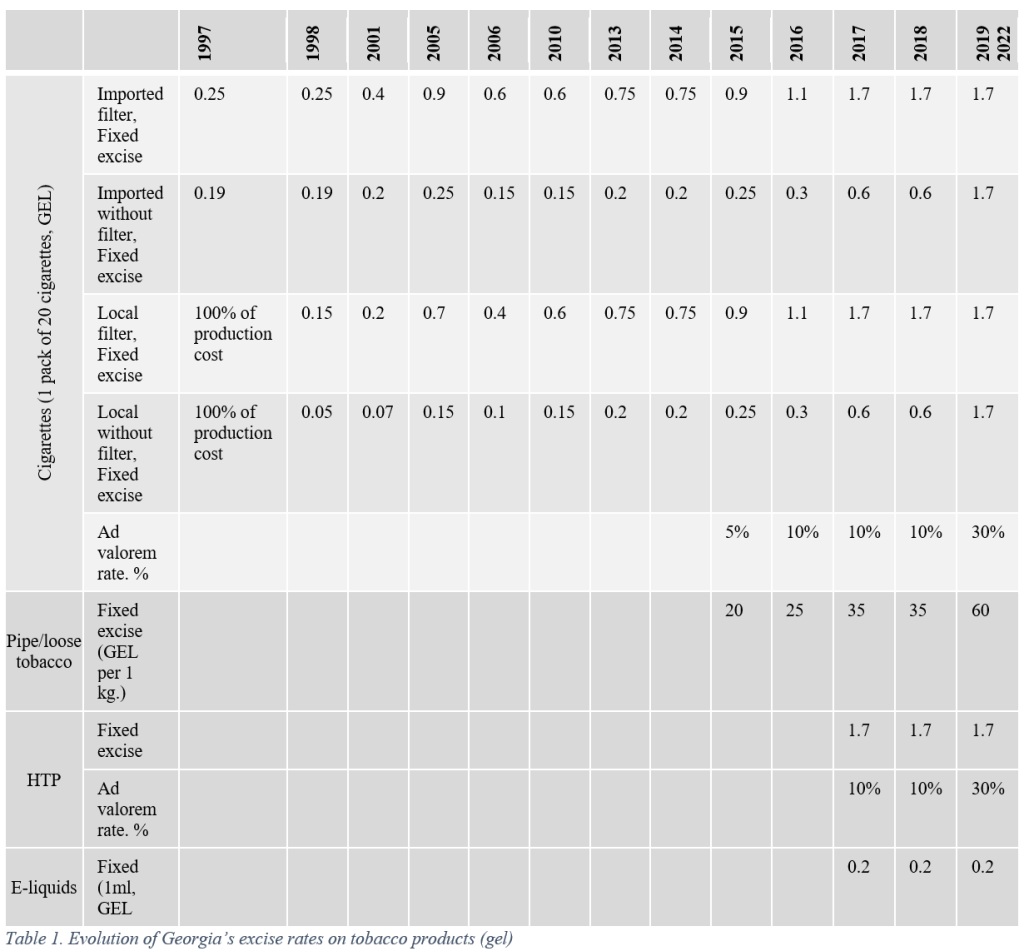

Excise duty – fixed and ad valorem. An excise is an effective tool in tobacco policy management. Between 1991 and 1997 there was no tax on either locally produced or imported cigarettes. The situation changed in 1997 when imported cigarettes were levied a specific excise and customs tax of 0.25 GEL (about US$ 0.19) and 0.19 GEL (about US$ 0.15) per pack of filter and non-filter cigarettes, respectively. Locally produced cigarettes, on the other hand, were levied an excise tax worth 100 percent of their production costs. The following year, both imported and domestic cigarettes were levied a specific excise tax with substantially lower rates for domestic cigarettes. A new era of tobacco taxation in Georgia began in 2010 the government equalized the excise tax rates for imported and locally manufactured cigarettes by raising the rate for domestic cigarettes to the level for imported cigarettes. On the other hand, the gap between the tax rates on filtered and non-filtered cigarettes still remained and encouraged downward substitution instead of a reduction in smoking.

In 2015 Georgia adopted a mixed tobacco tax system by adding an ad valorem component to the excise duty. The base for calculating the ad valorem tax is retail prices set each year by order of the Ministry of Finance.

In addition, substantial tax increases took place in 2015-2019 with the goal of reaching the current EU tax level (1.8 Euro per pack, or about 6 GEL) within about 10 years following the Association Agreement. These tax increases resulted in a higher share of tax in the retail price and additional tax revenue. As of January 2019, all sorts of imported and domestic cigarettes, incur a specific excise tax of GEL 1.70 (0.70 USD) per pack. In addition, each pack is also levied 30 percent ad valorem excise.

Excise taxes are also levied on pipe/loose tobacco at GEL 60 per kilogram. This translates to GEL 1 per pack, assuming 0.8-1 g of tobacco per cigarette, a rate lower than the rate of conventional cigarettes (1.7 GEL).

Comparative indicators in Georgia, Moldova and Ukraine

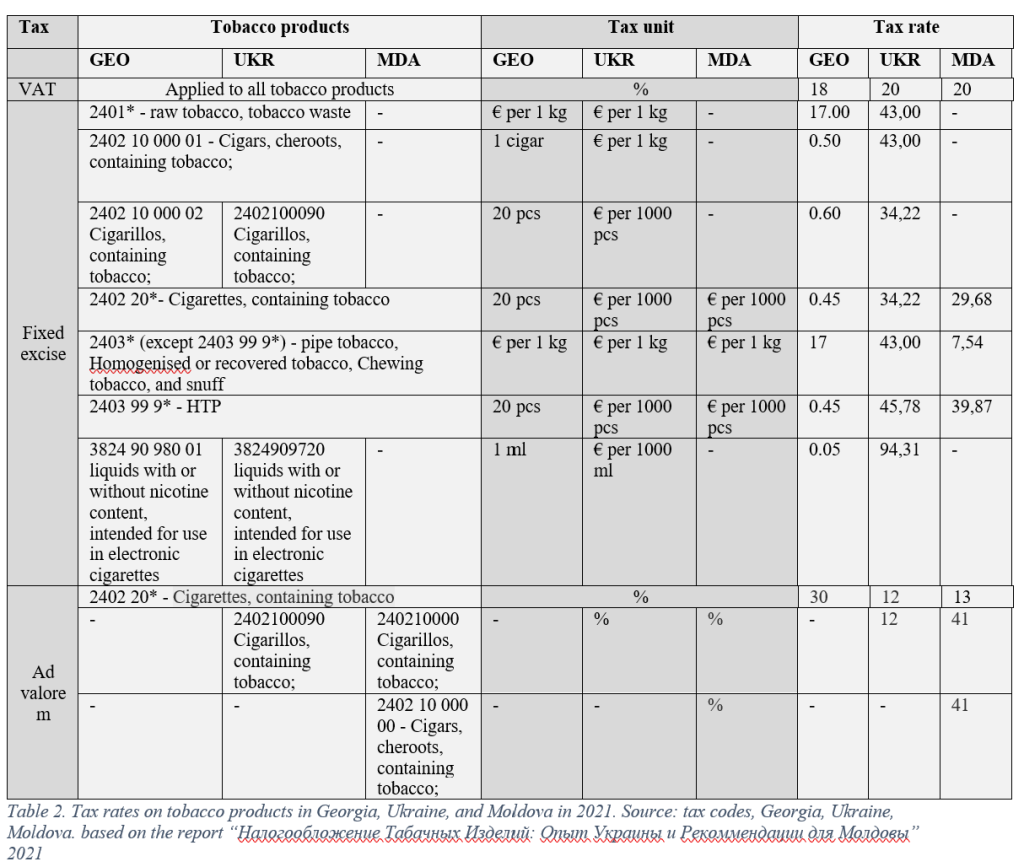

For more clarity, taxes on tobacco products in Georgia (fixed excise, ad valorem excise, VAT) are converted into euros and compared with similar figures in Ukraine and Moldova.

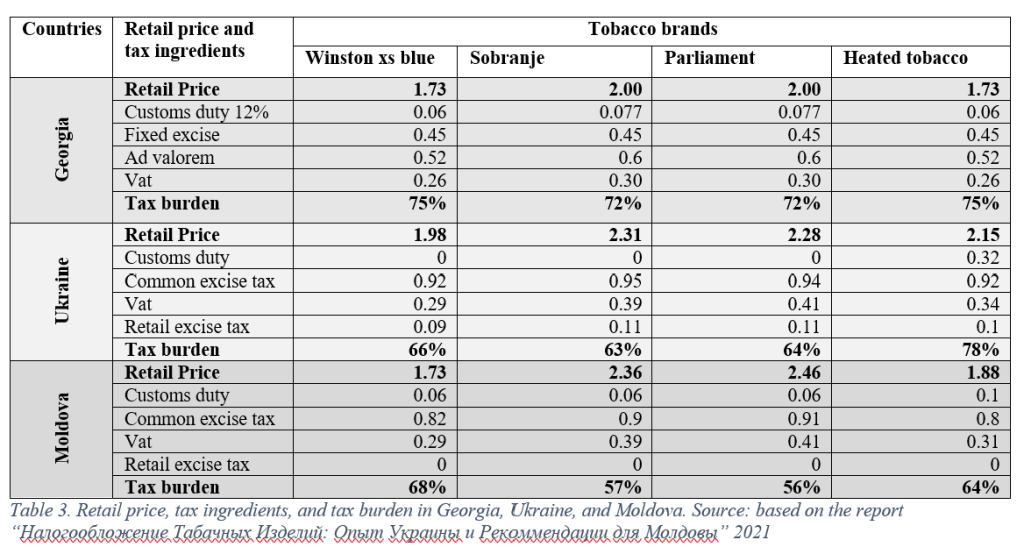

A comparison of Georgian tax rates with the tax rates of Ukraine and Moldova shows that they are much lower in Georgia. However, on the other hand, these data can be analyzed according to the share of a tax burden in the retail price of tobacco. Table #3 reflects the share of the tax burden on popular tobacco brands sold in Georgia, Ukraine, and Moldova. For Georgia, the tax burden on the indicated cigarette brands is in the range of 72-76%. Similar figures are much lower in Moldova (tax burden 57-68%), and in Ukraine (tax burden 63%-66%. The only higher tax burden is on HTP, caused by adding customs duty -78%).

Tax burden and affordability

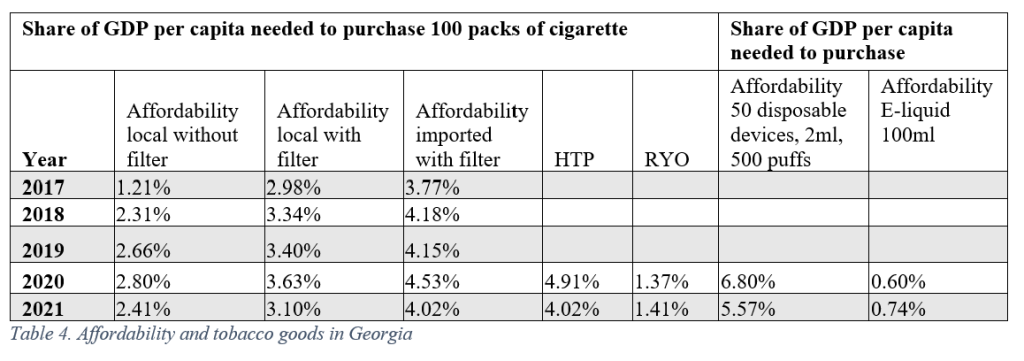

Although the tax burden is high, tobacco taxation rates in Georgia remain unchanged since 2019. This led to two undesirable results. First, the availability of tobacco products has increased in 2020 and 2021 years, and second, there is an imbalance between the tax rates on regular cigarettes (+heated tobacco) and other tobacco products, which distorts the taxation effect and stimulates consumers to switch to cheaper tobacco products. In this regard, it is noteworthy that the tax burden on RYO products and e-liquids is quite low: RYO-55%, E-liquids (1ml) – 40%, Disposable e-cigarettes (2ml, 500 puffs) – 17%.

Table #4 shows another important factor of affordability. Affordability is calculated as the share of GDP per capita needed to purchase 100 packs of cigarettes. Affordability is increased on all sorts of tobacco products except RYO and E-liquids, which are themselves very low compared to other tobacco products.

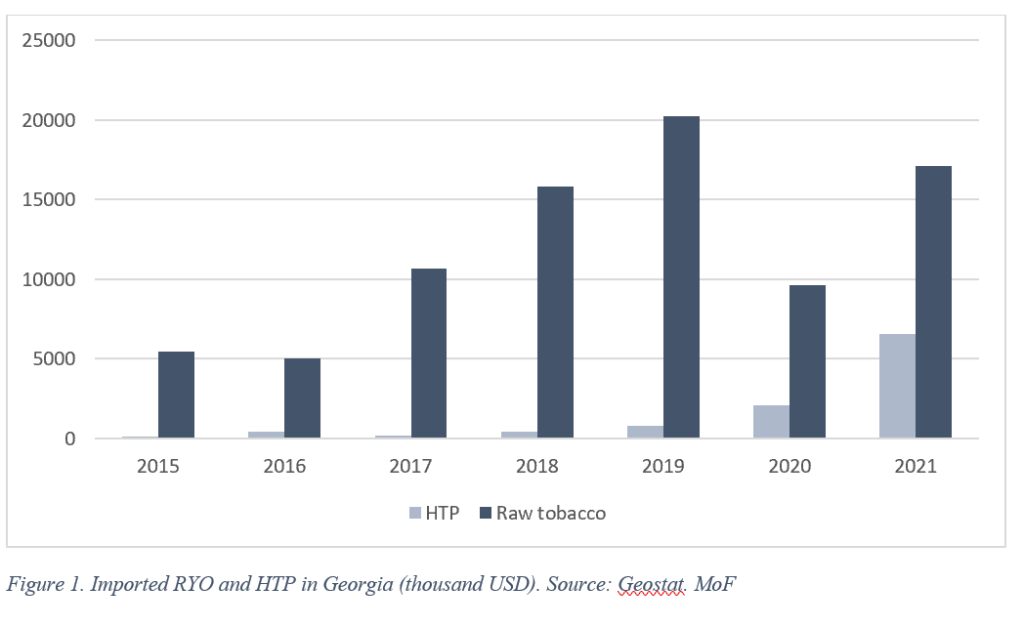

A combination of affordability and tax burden shows where the demand will shift – this is RYO products. Figure #1 shows the import trend of RYO tobacco, which went high in 2021, in addition, increased affordability caused the increased trend in HTP import.

Conclusion

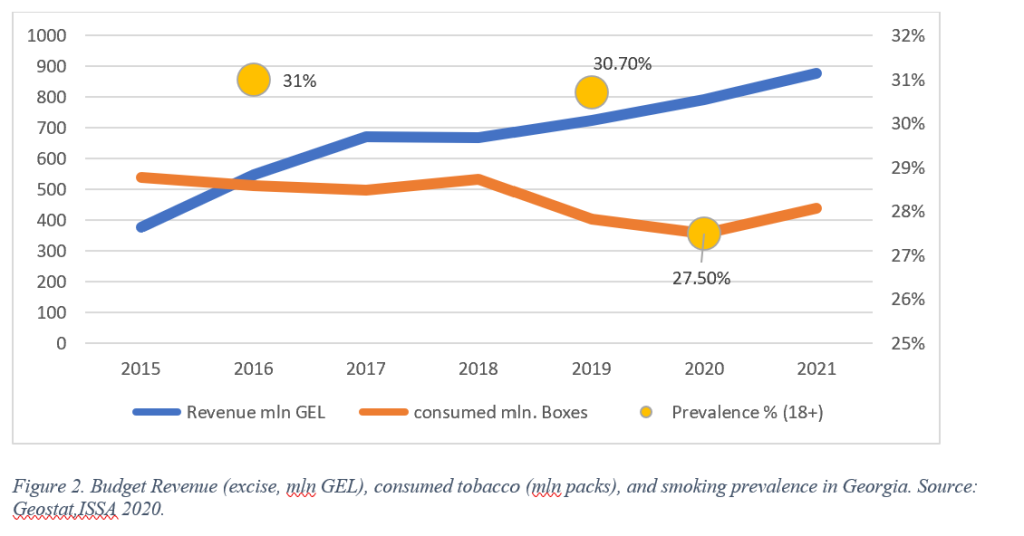

In conclusion, the last figure clearly shows both positive and adverse results of the Georgian tobacco taxation policy and its impact on consumption and budget revenues. Two goals of tobacco policy were successful till 2020 when excise taxation rates were new. Tobacco consumption and prevalence decreased by 12% compared to 2019, while budget revenues increased year by year. However, the indicators of tobacco consumption have worsened in 2021. Among the main factors which stimulated increased consumption and prevalence (most likely. no data for prevalence in 2021) rates, are frozen excise tax rates and affordability encouraged by inflation (average annual rate of 9% in 2021), and increased personal incomes (13% higher in 2021 than in the previous year).

References

Code of Administrative Offenses of Georgia

Georgian law on tobacco control

Georgian law on advertising

Georgian law on broadcasting

Georgian law the technical regulation on the standardization of tobacco products and their packaging

Hana Ross and George Bakhturidze. GEORGIA: Controlling Illicit Cigarette Trade. Chapter In the book Confronting Illicit Tobacco Trade, A global review of country experiences. technical report of the world bank group, global tobacco control program 2019

Information on export-import of Georgia – Ministry of Finances of Georgia. https://mof.ge/export_importis_informacia

Tax Code of Georgia

P. Iavorski. Taxation of tobacco: Ukraine experience and recommendation for Moldova 2021, Report.

Share this content: